当前位置:首页 > 最新 > Stock Market Maneuvering Amidst the AI Craze: An Investment Conundrum Between Optimism and Skepticism

From Nvidia's sell-off and Oracle's stock price plunge due to surging AI spending, to the deteriorating market sentiment towards OpenAI-related companies, recent volatility in the AI sector has divided investors' attitudes towards this disruptive technology. Looking ahead to 2026, the core debate is becoming increasingly clear: should investors reduce their AI exposure before a potential bubble bursts, or should they buck the trend and increase their investment to seize the technological dividends? The outcome of this game will not only concern the fate of tech giants but will also profoundly impact the future of global stock markets.

A head-on clash between optimism and worry

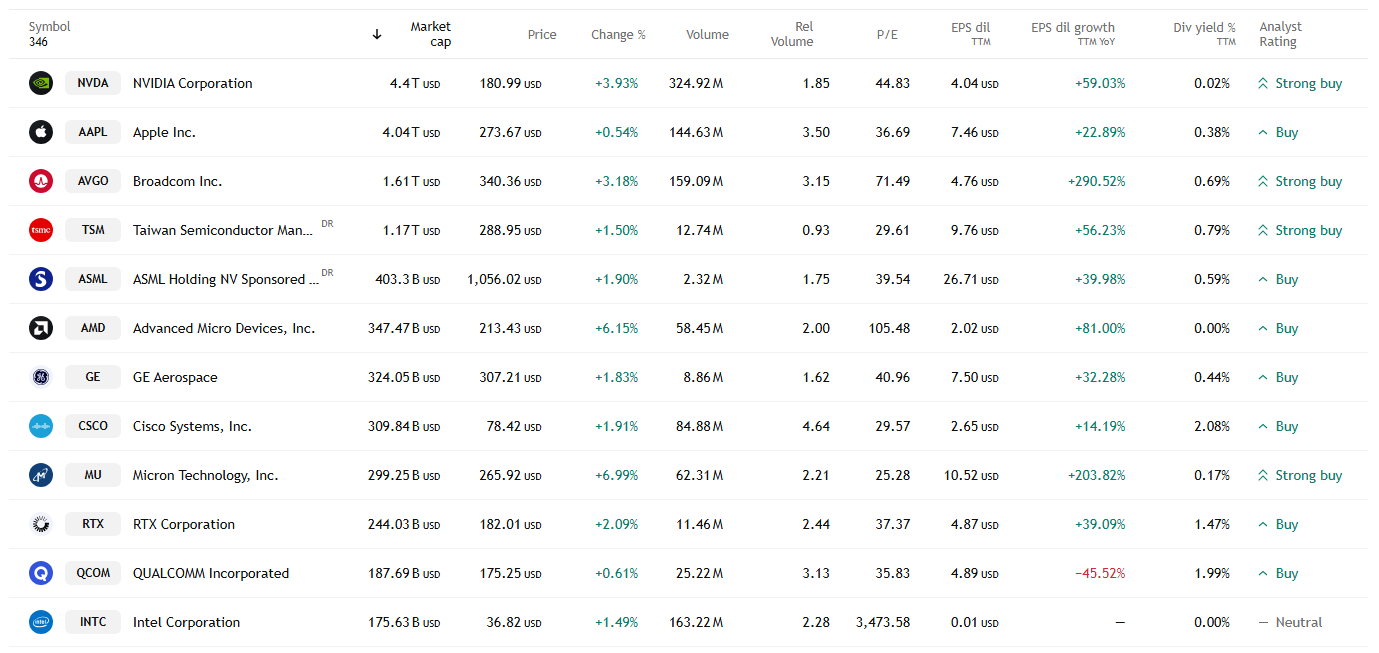

Options traders have demonstrated their strong confidence in AI stocks through their actions. Derivatives market data shows that the ratio of open call options to put options on the "Big Seven" tech stocks is approaching its peak since March 2023, indicating that traders are actively positioning for price increases. This optimism is not unfounded—breakthrough advancements in AI technology have driven the "Big Seven" index up 25% this year, with Nvidia becoming the first company to surpass a $5 trillion market capitalization. These tech giants have contributed significantly to the year's stock market gains.

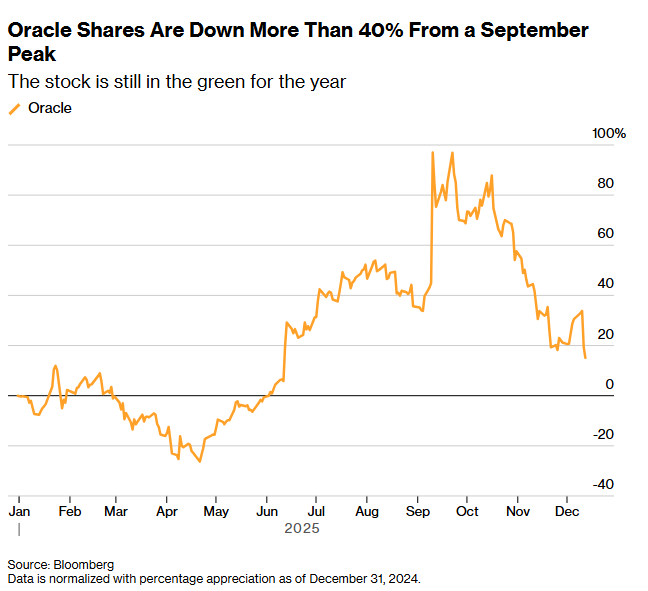

The optimists' confidence is also supported by fundamentals. Of the 39 global investment managers surveyed by Bloomberg, the majority agreed that the valuations of the "Big Seven" are supported by fundamentals, believing it marks the beginning of a new industrial cycle. Meanwhile, expectations of a Fed rate cut have eased market anxiety, with the expected volatility of tech stocks relative to the broader market halved from a year-to-date high of 8% to 4%. Miller Tabak strategist Matt Maley also pointed out that year-end institutional allocation demand may further boost tech stocks. However, skepticism is equally strong. Callodine Capital CEO Jim Morrow stated that the market has entered a "test of the waters" phase, with the core contradiction being the "high investment, uncertain output" of the AI industry. For example, OpenAI plans to spend $1.4 trillion over the next few years, with cash flow not expected until 2030; Oracle, after massively raising funds to build AI data centers, saw its stock price fall by more than 40% from its peak due to underperformance, and its credit risk has risen to its highest level since 2009.

The Triple Reality of High Investment, Slow Growth, and Rational Valuation

The "cash-burning model" of the AI industry is reshaping the financial structures of tech giants. Alphabet, Microsoft, Amazon, and Meta are projected to spend over $400 billion in capital expenditures over the next 12 months, with the vast majority going towards data center construction. While AI has brought revenue growth to cloud computing and advertising, it's still a drop in the ocean compared to the massive investments. Bloomberg Intelligence data shows that the "Big Seven," including Apple, Nvidia, and Tesla, are projected to see only 18% profit growth in 2026, the slowest pace in four years, just slightly above the S&P 500 average.

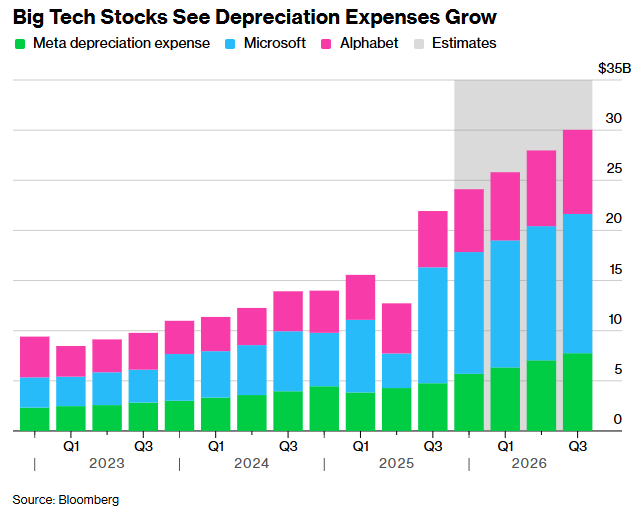

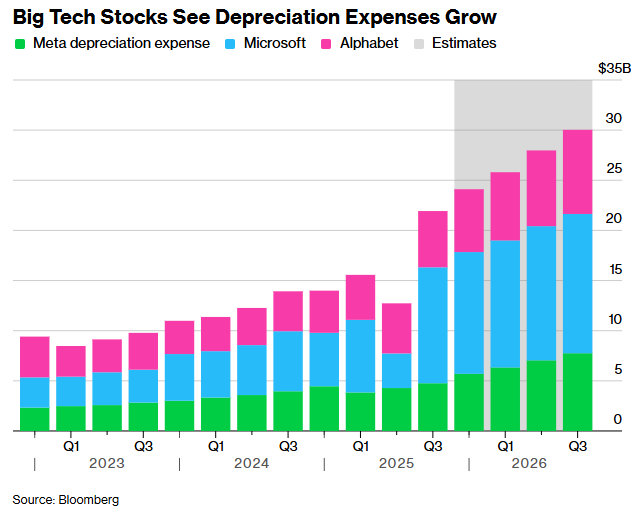

The massive expansion of data centers has also raised concerns about soaring depreciation costs. In the fourth quarter of 2023, Alphabet, Microsoft, and Meta's combined depreciation costs were approximately $10 billion, rising to nearly $22 billion by the September 2024 quarter, and are projected to exceed $30 billion by the same period in 2025. This cost pressure directly impacts shareholder returns—after deducting share buybacks and dividends, Meta and Microsoft's free cash flow may turn negative in 2026, and Alphabet will barely break even. Michael O'Rourke, chief market strategist at Jonestrading, warned: "Once growth expectations stagnate or slow down, the market will realize there are serious problems here."

It's worth noting that despite ongoing controversy, current valuations of AI-related stocks haven't reached the extreme levels seen during the dot-com bubble. The Nasdaq 100 index, dominated by tech stocks, currently has a price-to-earnings ratio (P/E ratio) of 26 times expected earnings, while this figure exceeded 80 times at the peak of the dot-com bubble. Tony DeSpirito, Global Chief Investment Officer at BlackRock, points out, "This isn't a repeat of the dot-com bubble; the valuations of AI-related stocks among the 'Big Seven' don't exhibit any obvious irrational exuberance." Specifically, companies like Palantir and Snowflake have P/E ratios as high as 180 and 140 times respectively, placing them in the high-valuation category; however, Nvidia, Alphabet, and Microsoft all have P/E ratios below 30, which is relatively moderate compared to their market hype.

The Triple Test of Capital, Policy, and Strategic Transformation

Sustainability of capital is the lifeline of the AI industry. While OpenAI has raised $40 billion from investors like SoftBank and secured a $100 billion investment commitment from Nvidia, this cyclical financing model has raised market concerns. Eric Clark, portfolio manager at Rational Dynamic Brands Fund, warned: "Trillions of dollars are concentrated in a few AI-themed stocks; if short-term problems or valuation imbalances occur, the funds could collectively withdraw." The pressure is even more pronounced for companies like Oracle that rely on debt financing—bondholders need to receive cash payments on schedule, which is far less tolerant of returns than equity investors, making their AI expansion plans face greater financial constraints.

The Federal Reserve's policy moves have become a significant external factor influencing market sentiment. Futures market pricing indicates an 88% probability of a Fed rate cut, and investors are closely watching Powell's press conference for clues about future interest rate policy. The expectation of a rate cut has not only eased financing pressures on technology companies but also provided liquidity support for the stock market, becoming a key source of confidence for optimists. However, Gareth Ryan, Managing Director of IUR Capital, holds the opposite view, predicting that US stocks may retest the 6500-point low in the first few months of 2026, believing that current optimism is insufficient to offset potential fundamental risks.

The strategic transformation of large technology companies is itself fraught with uncertainty. For a long time, the core value of tech giants has lay in achieving rapid revenue growth at low cost, thereby generating substantial free cash flow. However, AI initiatives have completely overturned this logic—companies are leveraging heavily to invest in AI infrastructure, hoping to monetize it in the future. O'Rourke bluntly stated, "If we continue down this path, valuation multiples will shrink; if we fail to achieve our goals, this transformation will be a huge strategic mistake." This transformation brings not only changes to financial structures but also a restructuring of the market's valuation system for technology companies.

The game continues, but the trend will eventually become clear.

The current AI stock market is at a crossroads of contradictions: bullish bets from options traders are offset by spending pressures at the industry level; rational valuation levels are intertwined with uncertain investment returns; and expectations of easing policies from the Federal Reserve coexist with the potential risk of a correction. The S&P 500's three-year, $30 trillion bull market has been highly dependent on the support of AI-related tech giants. If these companies' growth slows, the index will inevitably be dragged down. For investors, the key to this game is not simply being bullish or bearish, but rather seeing through the noisy market sentiment and accurately assessing the technological barriers, profit paths, and financial resilience of different AI companies. In 2026, as AI technology is implemented and investment returns gradually become apparent, this investment enigma surrounding the technological revolution will finally have a clear answer.

Stock Market Maneuvering Amidst the AI Craze: An Investment Conundrum Between Optimism and Skepticism

AI熱潮下的股市遊戲:樂觀與質疑交織的投資迷局

WMax行为金融:当金价飙升时,你的大脑正在如何欺骗你?

在不确定市场中,坚守确定的交易基础设施

高波动下的可靠执行与用户保障

Intelligent Evolution, Enhanced Experience: A Comprehensive Analysis of Ace Markets Trading Platform's New Features

Stock Market Maneuvering Amidst the AI Craze: An Investment Conundrum Between Optimism and Skepticism

Stock Market Maneuvering Amidst the AI Craze: An Investment Conundrum Between Optimism and Skepticism

AI熱潮下的股市遊戲:樂觀與質疑交織的投資迷局

AI熱潮下的股市遊戲:樂觀與質疑交織的投資迷局